Creative Money aims to have an open conversation about finances in the creative industries.

It was founded in July, 2020 in an attempt to address a frustrating lack of relatable financial guidance for creative workers and is written by me, Matt Parker, a music journalist and lecturer.

Hello! How are you? I missed you.

I hope this finds you as well as possible in these strange times. Creative Money is back from an extended ‘break’ (thank you lockdown and nursery closure) with a slightly refreshed look. This is due to the newsletter’s new home on the much-more-user-friendly Substack. Like it? Hate it? Let me know what you think!

You’ll find the usual (UK-focussed) succinct news round-up of things at the crossroads of creative careers and personal finance below, plus an updated list of funding opps.

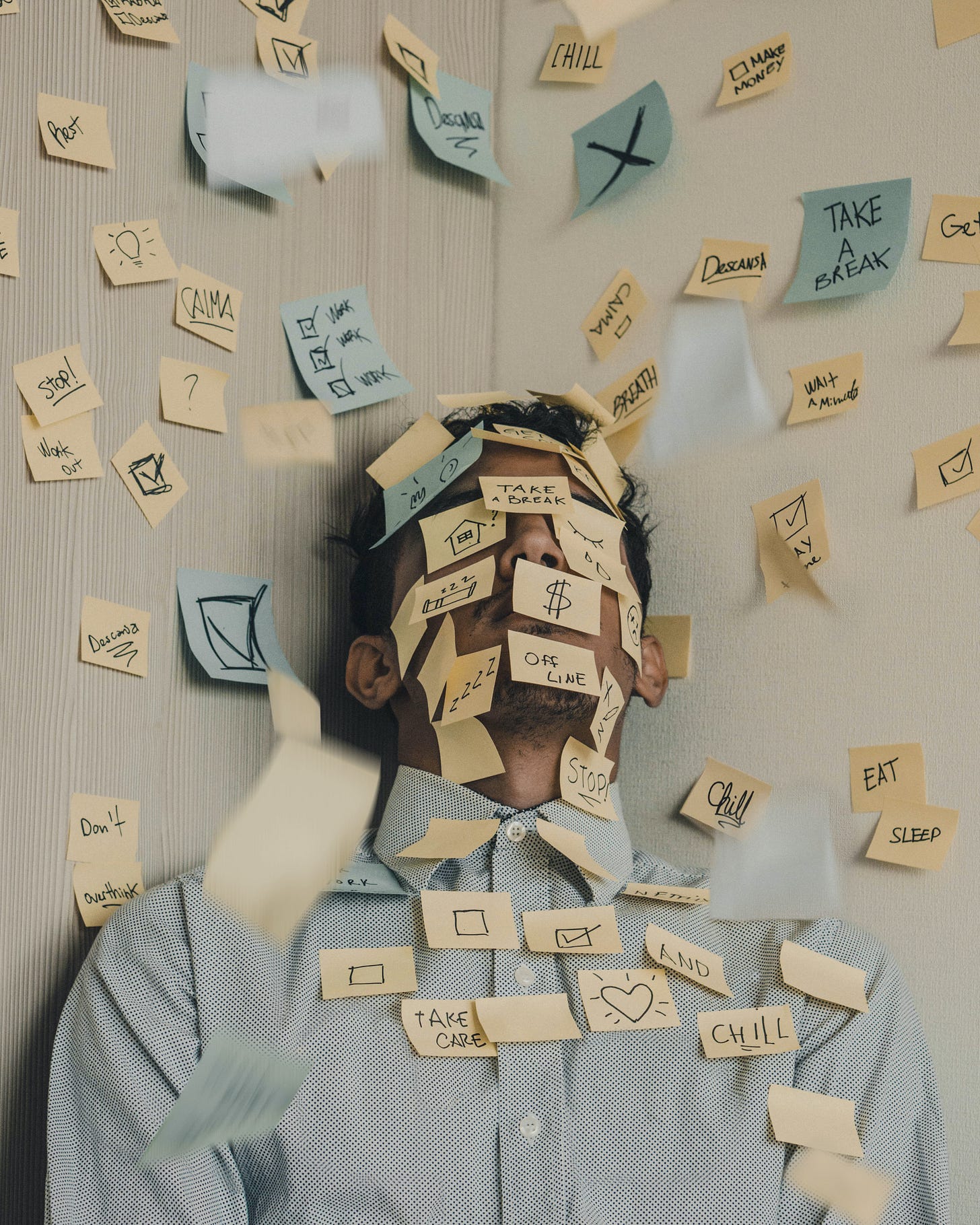

This week the self-assessment tax deadline looms on the horizon (31 January, 2021). This is your last chance to calculate and pay your tax for self-employed earnings for 2019-2020. It’s a date that causes a lot of anxiety for creative workers – and that will be the case for more of us than usual in 2021. As a result, there are a few things I’d like to flag…

1. If you’re worried about your tax situation, talk to HMRC

If you’re worrying about making your payment or filing on time this year, be proactive, contact HMRC and let them know. They genuinely are pretty helpful and much more accommodating than their reputation of old. It’s often going quiet or ‘off-radar’ when you owe them that gets you into trouble/court. Fortunately, in light of the pandemic HMRC have made paying (or delaying) easier than usual this year…

2. This year you can spread payments over a further 12 months using Time To Pay

I’ve reported previously on the fact that HMRC had waived late fees on July 2020 self-assessment payments, allowing you to defer them until this month. However, now they’re expanding the Time To Pay service, to allow payments to be spread over the next 12 months. You will get charged a small amount of interest on this (2.6% APR), so avoid it if you can, but that’s a pretty friendly rate, if you need it…

3. Are you aware of the Simplified Expenses option?

If, like my partner, you hate doing your expenses so much you’re sometimes tempted not to claim them at all, remember you may have the option of using Simplified Expenses. It can take a lot of the headache out of calculating mileage, home office costs etc.

As a final motivational tidbit, claiming her self-employed expenses meant my wife’s tax calculation avoided tipping her onto the payments on account system, so she has to find about a grand less for HMRC this calendar year. Sometimes a small inconvenience can make a massive difference to your cashflow.

Until next time,

Matt

What do you need to know this week?

How to fill in a self-assessment tax return (Money Advice Service)

'I definitely made more in ad revenue than I paid for the car': How YouTubers balance their books (Lance)

Major label CEOs are going to have to justify streaming rates in front of the DCMS Committee on 19 January (Twitter/#BrokenRecord campaign)

COVID-19: Redundant theatre workers in Manchester use skills to retrofit homes (Sky News)

Grants and funding opportunities for UK creative workers

Arts Council Cultural Recovery Fund

The second round of the Arts Councils Covid-19 support funding is now open. This is the fund for cultural organisations in England and you can apply for £25,000 - £1M in support. Note: you will need to register on Grantium by 21 January, 2021 if you’re not already on the system. Deadline: 26 January, 2021

Comic Art Europe Open Call

Comic Art Europe launches a call for projects for European authors on the theme “Visions of tomorrow”. Selected artists will be awarded a €5,000 grant and a two-week residency. Deadline 31 January, 2021

Youth Music Incubator Fund

Grants of £5,000 - £30,000 to businesses, collectives and not-for-profits working in the music industries to open up sustainable music careers for 18-25yr olds. Deadline: 5 February, 2021

Fair Earth Creative Entrepreneurs Fund

The entrepreneurs fund is a £10,000 grant awarded to one inspiring entrepreneur, along with a mentor, to help set up their own business. Deadline: 14 February, 2021

Maltings Theatre Our Towns Theatre Fund

Grants of £500-£5,000 open to artists living in South East towns who want to create artistic work where they live, with and for their town community. Deadline: 15 February, 2021

Arts Council Developing Your Creative Practice

The fund supports creative practitioners thinking of taking their practice to the next stage to research, have time to create new work, travel, training, develop ideas, network or find mentoring. Deadline: 18 February, 2021

Dance Professionals fund

Grants of up to £2,000 for dancers, dance teachers and choreographers affected by Covid. Applicants must be able to show that they were recently in paid employment in the dance profession up to the start of COVID-19 restrictions. Deadline: March, 2021

ArtCry grants

ArtCry is setup to provide a rapid turnaround of funding for art works responding to current events. Grants of up to £5,000 with a panel of artists, activists, creators and producers making decisions on applications within a week. Deadline: ongoing

Help Musicians Hardship Fund

The third phase of one of the major support funds for musicians is now open and will support successful applicants with a monthly top-up until March 2021. Deadline: ongoing

Actor's Children Trust hardship grants

ACT continues to pay Corona-crisis grants of £300 per family per month towards food and bills, as well as specific grants for children’s costs. Please use the contact form so we can check your eligibility as an actor under ACT’s criteria. Deadline: ongoing

Royal Variety Charity Financial Assistance grants

The Royal Variety Charity is uniquely positioned to provide financial assistance to anyone who serves any facet of the Entertainment Industry. Deadline: ongoing

The White Pube Writers Grant funded by Creative Debuts

£500 given out monthly to a working class writer based in the UK. This grant has been set up to support writers of all ages who are early in their careers and would benefit from this no-strings attached financial support to help them in whatever they like. Deadline: ongoing

Doom scroller? Follow Creative Money on social media!

Disclaimer: This is information – not financial advice or recommendation.

The content and materials featured or linked to on CreativeMoney.co.uk or our emails are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such.

Always do your own research and seek independent financial advice when required. Any arrangement made between you and any third party named or linked to from the site is at your sole risk and responsibility. Creative Money and its associated writers assume no liability for your actions.

Investing carries risks: The value of investments and any income derived from them can fall as well as rise and you may not get back the original amount you invested.

Disclosure: When content is published about a company or organisation with which Creative Money has a commercial relationship or interest (such as an advertiser or sponsor) that fact will be clearly disclosed in the article.